Billion car companies suddenly announced: termination!

China Fund News reporter Yishan

On July 12th, Zotye Automobile, which has recorded 8 days and 5 boards, was exposed to double negative, which not only officially announced the termination of the 6 billion yuan fixed-income project, but also revealed that the company’s net profit in the first half of the year was expected to be negative.

According to the previous announcement, Zotye Automobile plans to issue no more than 1.521 billion shares (including the number) to specific targets, and raise no more than 6 billion yuan (including the number). The raised funds will be used for new energy intelligent networked automobile development and R&D capacity improvement projects, channel construction projects and supplementary liquidity.

As for the reason for the termination, Zotye Automobile said that it was a decision made after comprehensive consideration of the changes in the external market environment, the actual situation of the company, the controlling shareholder and the actual controller planning to change the actual controller of the company, and full communication with relevant parties such as intermediaries.

8 days and 5 boards! Since July, the share price has risen by over 52%.

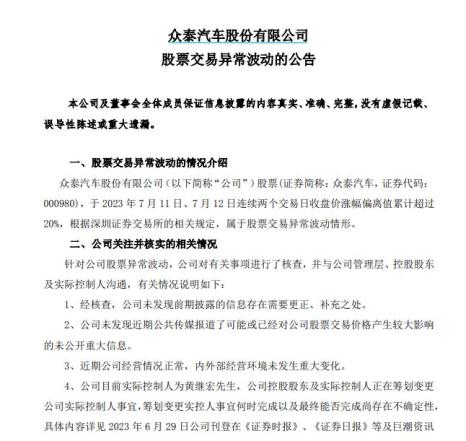

On July 12, Zotye Automobile announced the abnormal fluctuation of stock trading. On July 11 and July 12, the deviation of the closing price of the company’s stock for two consecutive trading days was more than 20%, which was an abnormal fluctuation of stock trading according to the relevant regulations of Shenzhen Stock Exchange.

In fact, since July, Zotye Auto’s share price has risen sharply. As of the close of July 12, Zotye Auto reported 3.75 yuan per share, an increase of 9.97%. In the past eight trading days, it has recorded five daily limit boards, with an interval increase of over 52%. Once again, it has become the strongest "monster stock" in the recent new energy automobile sector.

In this abnormal fluctuation announcement, Zotye Automobile disclosed the relevant situation that the company paid attention to and verified.

First of all, after verification, the company found no need to correct or supplement the information disclosed in the previous period; No major undisclosed information that may or has had a great impact on the company’s stock trading price has been reported by the public media recently; Recently, the company’s operation is normal, and the internal and external operating environment has not changed significantly.

Secondly, Zotye Automobile said that the controlling shareholder and actual controller of the company are planning to change the actual controller of the company, and there are still uncertainties about when the planning to change the actual controller will be completed and whether it can be completed in the end. It is understood that at the end of May this year, Huang Jihong, the "white knight" who pulled the company back from the brink of bankruptcy, resigned as chairman for personal reasons. At the end of June, Zotye Automobile announced that the actual controller of the company may change.

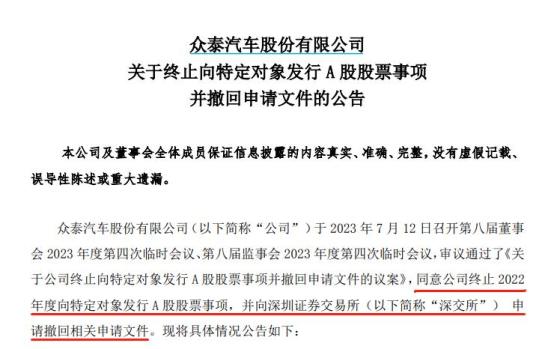

Finally, it was in this announcement that Zotye Motor suddenly announced the termination of the 6 billion fixed-income fundraising.

The 6 billion fixed-income project suddenly ended.

According to the announcement previously issued by Zotye Automobile, the company plans to issue no more than 1.521 billion shares (including the number) to specific targets, and raise no more than 6 billion yuan (including the number). The raised funds will be used for the development of new energy intelligent networked vehicles and R&D capacity improvement projects, channel construction projects and supplementary liquidity.

On March 15th, Shenzhen Stock Exchange issued an inquiry letter, pointing out that the net assets attributable to the parent company at the end of the latest period were 3.025 billion yuan, and the total amount of funds raised this time was nearly twice that of the company at the end of the latest period. In addition, Zotye Auto is also required to explain the specific process of the new energy vehicle development project from research and development to official listing, and whether the company has the ability to develop new energy vehicles.

On May 9, the Shenzhen Stock Exchange issued a second round of inquiry letter, but since May 17, Zotye Automobile has disclosed nine delayed reply announcements. In the announcement on July 11, the company said that it would disclose the reply to the second round of audit inquiry letter before July 18.

However, at the fourth interim meeting of the Eighth Board of Directors in 2023, the Board of Directors of Zotye Automobile unanimously reviewed and approved the Proposal on the Company’s Termination of Issuance of A Shares to Specific Objects and Withdrawal of Application Documents. Decided to terminate the issue of A shares to specific targets in 2022, and applied to Shenzhen Stock Exchange to withdraw the application documents.

Regarding the reasons for the termination, Zotye Automobile said that since the company disclosed the plan to issue shares to specific targets, the company and relevant intermediaries have actively promoted related work. After comprehensively considering the changes in the external market environment, the actual situation of the company, the controlling shareholder and the actual controller planning to change the actual controller of the company and other factors, and after fully communicating with relevant parties such as intermediaries, the company decided to terminate the issue of shares to specific targets and withdraw the relevant application documents.

The risk of liquidity shortage remains.

After bankruptcy and reorganization, Zotye Auto successfully took off its hat in November last year, but it is not optimistic in terms of operating performance and asset status.

According to the financial report data, the company’s revenue declined year by year from 2018 to 2022. In 2018, the company’s revenue was still 14.764 billion yuan. By 2022, the company’s revenue was only 783 million yuan, and the company’s revenue shrank by over 94% in four years. In terms of net profit, the company has been losing money since 2019. Although the loss has narrowed, the net loss of the company has exceeded 23.6 billion yuan in the past four years. At the same time, Zotye Auto also revealed in the latest announcement that although the specific figures have not yet been counted, the company initially expects the net profit for the first half of 2023 to be negative.

By the end of 2022, the company’s net assets returned to its mother were 2.437 billion yuan, its total liabilities exceeded 4.6 billion yuan, and its ending cash balance was 116 million yuan. According to the company’s announcement, as of the end of the first quarter of this year, the company’s monetary funds were 922 million yuan, including 867 million yuan of restricted funds, and only 55.1074 million yuan of freely usable funds remained. This is obviously a drop in the bucket for a manufacturer with vehicle production qualification and Zotye Automobile, which will invest a lot of money in vehicle production and manufacturing in the future.

Zotye Auto also bluntly stated in the previous announcement that if the company’s external financing channels are not smooth, or the accounts receivable cannot be recovered on schedule or cannot be recovered, or the supplier fails to restore a reasonable credit period to the company for a long time, the company may face the risk of liquidity shortage, which will adversely affect the normal operation of the company.

In fact, due to the lack of liquidity, Zotye Automobile’s vehicle manufacturing almost came to a standstill in 2020 and 2021. In recent years, the company’s revenue mainly came from the sales of auto parts and door industry. Although the company has announced that it will gradually resume the whole vehicle business in 2022, and has completed the remodeling of core functional departments such as production, sales and research and development, it is not easy for Zotye to transform its new energy vehicles in the new energy vehicle market where the competition among new car-making forces such as Ideal, Weilai and Tucki is becoming increasingly fierce. In addition, as a vehicle manufacturer with an annual sales volume of more than 300,000 vehicles, Zotye Automobile sold only 502 vehicles in 2022.

In the previous increase specification, Zotye Automobile revealed that it will invest 5.037 billion yuan in the new energy intelligent networked vehicle development and research and development capability improvement project, including three parts: new energy intelligent networked vehicle development, common technology research and development and R&D center construction; In addition, 533 million yuan will be invested in channel construction projects. The company plans to build 216 self-operated stores in 100 cities including Beijing, Shanghai and Guangzhou in advance, covering major target markets and helping the company to quickly introduce new energy automobile products into the terminal consumer market.

According to the plan, if the above-mentioned 6 billion yuan fixed-income project finally lands, Zotye Automobile may be able to do a big job in the field of new energy vehicles. But now with the withdrawal of the fixed-income plan, where is the money for the company to build a car? Still a problem.

However, in the latest announcement, Zotye Automobile emphasized that all production and business activities of the company are proceeding normally at present, and the decision to terminate the fixed increase and withdraw the relevant application documents was made through full communication and careful analysis by the company’s management, intermediaries and other relevant parties. It will not have a significant adverse impact on the normal operation and sustained and stable development of the company, and there is no harm to the interests of the company and all shareholders, especially minority shareholders.

Wind data shows that as of July 10th, the total number of shareholders of Zotye Automobile reached 183,000, an increase of 34.56% compared with June 30th.

Editor: Huang Mei

Audit: Muyu

copyright statement

China Fund Newspaper enjoys the copyright of the original content published on this platform, and it is forbidden to reprint it without authorization, otherwise it will be investigated for legal responsibility.

Authorized Reprinting Cooperation Contact: Yu Xiansheng (Tel: 0755-82468670)

Original title: "Billion car companies suddenly announced: termination! 》

Read the original text